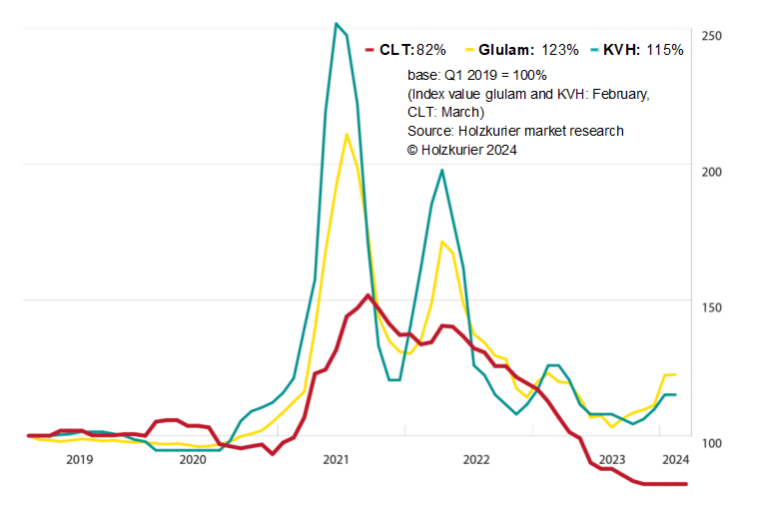

After prices for glulam and solid structural timber had increased in the fourth quarter, many cross-laminated timber manufacturers hoped, at the turn of the year, that the price of their product would soon follow suit. In January, some manufacturers even attempted to raise prices but gave up soon because no customer was willing to pay those prices.

For the second quarter, some market participants have once again announced moderate price increases. According to those in the industry, the number of requests for CLT has risen substantially in the last few weeks and, from an economic point of view, this step is now essential for many manufacturers.

“At the moment, we are just about able to pay for the raw material costs, but we are a long way from achieving a positive contribution margin. We can’t produce at a cheaper price,” one manufacturer comments. Their competitors describe the price situation with the words “ruinous”, “catastrophic”, “dramatic” or even “moronic”. Especially for bigger projects, manufacturers bought certain quantities in order to keep their already heavily adjusted productions running, but without making any money. Now, however, the majority of manufacturers emphasize that they are no longer able or willing to play this losing game.

Timber construction the exception that proves the rule?

In 2023, building permits in the German residential construction segment decreased by 27% or 94,000 units compared to the previous year. In January 2024, the lowest number in twelve years, i.e. almost 17,000 permits, was recorded. “No permits, no construction any time soon,” is how an industry expert sums it up, adding, however, that timber construction is still doing relatively well compared to the concrete or brick construction segments. In this respect, the very low CLT prices are said to definitely have a positive effect.

In fact, a more or less satisfactory order situation is reported for public projects, such as schools or kindergartens, but also for commercial buildings and renovations, whereas the single-family and residential construction segments have seen a massive slump.

Perseverance is required

“We are currently driving in thick fog,” one market participant says, describing his outlook on the future, and he is not alone. While the entire construction industry is struggling with high costs and historically high interest rates, geopolitical events, such as the wars in Europe and the Middle East, but also a landmark US presidential election with an uncertain outcome, make reliable economic forecasts difficult. It remains to be seen when there will be a sustainable improvement of the general framework conditions and whether building will become more attractive again – although this will probably only be the case in 2025 at the earliest.

And even when the construction industry has picked up again, it will still take some time for demand to actually catch up with the CLT capacities, which have recently been massively expanded.