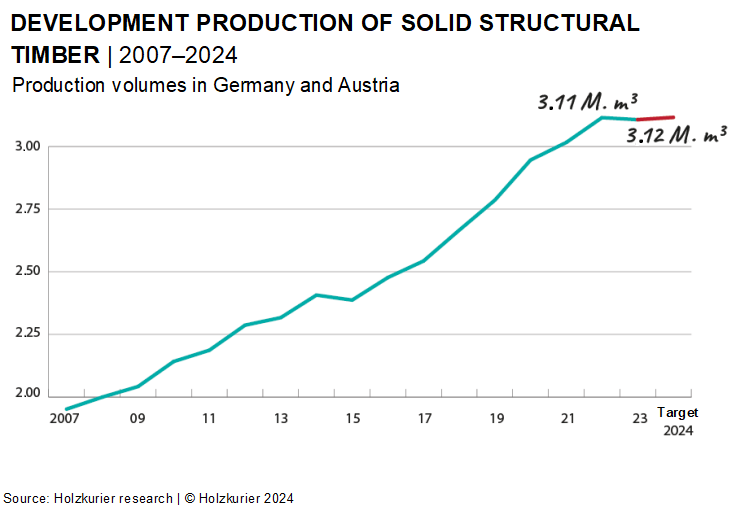

3.29 million m³ – this was the cumulative production output German and Austrian manufacturers of solid structural timber planned to achieve in 2023 when asked about it exactly one year ago. With an increase of 5%, this volume would have marked another record year. In the end, actual output amounted to 3.11 million m³ (according to the Holzkurier’s production survey and estimates) and is thus roughly the same as in 2022. For 2024, manufacturers are expecting a similar production output, which seems extremely optimistic given the latest building permit figures and economic forecasts.

In Germany, the number of building permits for housing units fell by 25.9% in the period January to November 2023, with decreases being particularly marked in the single-family (-38.6%) and two-family home segments (-49.2%). In residential construction, the ifo business climate index fell from -56.9 points in December 2023 to -59.0 points in January 2024. This is the lowest value ever recorded. The same can be observed when it comes to expectations, which fell further, from -64.7 to -68.9 points.

According to branchenradar.com, building permits for housing units in Austria saw a year-on-year decrease of 27% in 2023. Supported by the building permits of previous years, overall construction starts in 2024 will therefore fall by around 18% compared to 2023. In the single-family home segment, they will be down by almost 20%, as the online platform reports.

Cautiously optimistic

At the end of January, manufacturers of solid structural timber reported a demand which ranged from subdued to normal for the season. Timber trade is said to be rather hesitant in purchasing after stocking up on goods at the turn of the year. Meanwhile, prefabricated house manufacturers are purchasing significantly smaller quantities of solid structural timber compared to previous years, which is a result of their own order situation. Manufacturers’ reports about the timber construction sector are much more positive. In this area, they are quite optimistic, as many customers have well-filled order books and are ordering corresponding quantities. Thus, manufacturers have mixed expectations for 2024, with some being "cautiously optimistic" about the future.

€300/m³-mark exceeded

In terms of price, solid structural timber peaked at €350/m³ in February last year, before plummeting to €290/m³ in October and ending the year 2023 at €305/m³. This results in an average annual price of €314/m³.

Compared to the record average prices of 2021 (€466/m³) and 2022 (€399/m³), this is a substantial decrease – but nevertheless a strong increase compared to pre-Covid levels. As a look in the Datacube shows, the average price for solid structural timber exceeded the €300/m³-mark just once before that, in 2013.

Moderate price increase expected

Currently, the price is rising and reached around €320/m³ in January, with some manufacturers being more hesitant than others about raising prices, which led to large price spans on the market. The quick rise in raw material prices and the increase in transport costs were given as main arguments for the price increases, which were accepted without much resistance by customers.

For the current and the following months, manufacturers are already considering further price increases, which are expected to be rather moderate. €350 to €360/m³ are repeatedly stated as being "reasonable prices" given the current cost situation.

Will there be cut-throat competition?

What the year will bring for the entire solid structural timber industry and each individual manufacturer probably depends primarily on the construction industry. In addition, it remains to be seen how many manufacturers will adapt their production output in the event of weak demand and at what point there might be cut-throat competition.