For most segments of the European timber industry, the war in Ukraine only really began when the EU’s sanctions came into effect on July 10. Before that date, many companies kept up imports from the sanctioned countries. The European packaging companies are the exception here. Since Ukraine in particular used to be an important supplier for Italy as was Belarus for Germany, repercussions could be felt already in March.

Record price in 2022 as well

This development is reflected in the extraordinary increases in prices of packaging lumber. In Italy, the price of fresh 17 mm sideboards rose sharply, from €240/m³ in December to €350/m³ in March (free border Austria/Italy), equaling the all-time record price of June 2021.

Another indication of the shortage of wood packaging is the fact that the price has not fallen as sharply as other lumber products since the peak in March. Main products, such as raw wood for solid structural timber or laminations for glulam, have even become cheaper than sideboards.

Shortage of nails

At the same time, the war in Ukraine brought about unexpected new problems: There was an increasing shortage of nails because the suitable steel had previously been imported from eastern Ukraine. The German, Italian and Polish packaging industries were equally affected by this problem.

When it comes to imported pallets, the situation – in Germany, for example – is still relatively relaxed. Although imports from Belarus plummeted by 42%, a total of 44.2 million pallets were imported in the first seven months, which is 1% more than last year.

Plywood expensive, OSB cheaper

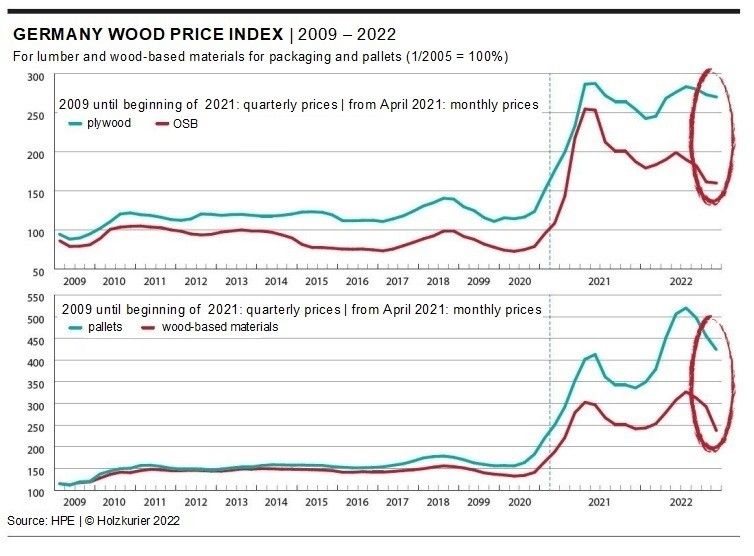

For European processing companies, the price of plywood remained nearly unchanged compared to last year. Manufacturers of crates, on the other hand, saw a marked year-on-year decrease in OSB prices (see chart above).

Now, in the third quarter, processing companies might have to start buying bigger volumes of wood again. This segment has been very hesitant when it comes to purchasing lumber this past summer. Right now, the log qualities which are usually reserved for packaging manufacturers are still scarce. In short, there is not enough “bad” log wood at the moment.

Energy prices hurt in three different ways

The high cost of energy is hitting processing companies in the following three ways:

- when it comes to log wood,

- when it comes to lumber

- and, in particular, when it comes to customers

Since €300 per ton of absolutely dry sawdust are already being paid in Germany, the question is: Why wait until the log wood in forests reaches the ideal size for being cut into packaging wood when wood for the generation of energy and sawmill byproducts is fetching good prices?

Wood chips instead of lumber

Sawmills are asking themselves the same question. When there are smaller volumes of sawmill byproducts accumulating as a result of reduced cutting, cutting patterns can be adapted in a way that wood chips are produced instead of thinner sideboards.

However, with electricity prices exceeding €1/kWh, the biggest threat to the industry is the uncertain future of energy-intensive customer segments. Already in June, there was talk of glass manufacturers shutting down production because the price of gas made production unprofitable. Since then, an increasing number of sectors and segments have been at risk.

In the coming months, there will be fewer and fewer possibilities for imports from the sanctioned countries. Cuttings from Ukraine for the production of EPAL pallets in particular are in short supply in Germany and Italy. As a result, it might be necessary to create new production capacities in Central Europe in order to produce wood with the required lengths.

In the past weeks, sawmills were surprised that the packaging industry “lived hand to mouth”, i.e. bought very small quantities of wood. There have already been warnings about a potential shortage of suitable log wood for packaging materials now in the early autumn. In general, “cheap log wood” will be scarce due to the prices of wood for the generation of energy.

Prices to reach the bottom soon

In September, prices for packaging wood could see a further, slight decrease. Then, however, they should have reached the bottom for good. Buyers are still struggling with the wide price ranges between the cheapest and the most expensive supplier.

Caution or recession?

At the moment, the big unknown is the further development of the economy. No other sector or segment is better suited as an economic barometer as the packaging industry. Whenever there is a decrease in orders, this industry feels it first. One can only hope that the packaging companies’ current hesitancy to buy wood is only a sign of caution and not an indication of an imminent recession.